Fintech Landscape in Latin America

Author: Andrew Woolston (Intern)

Reviewed by: Ralph DiFiore (CCO), Marcus Magarian, Chris Gioffre

The financial technology boom observed over the past few years has significantly impacted Latin America’s fintech ecosystems. As discussed in the Payments in the Middle East article, rapid growth in smartphone and internet adoption is fueling fintech VC and M&A markets in Latin America. Small and medium-sized businesses have increased access to banking and financial services resulting in an abundance of fintech startups in the region.

LatAm Fintech Growth

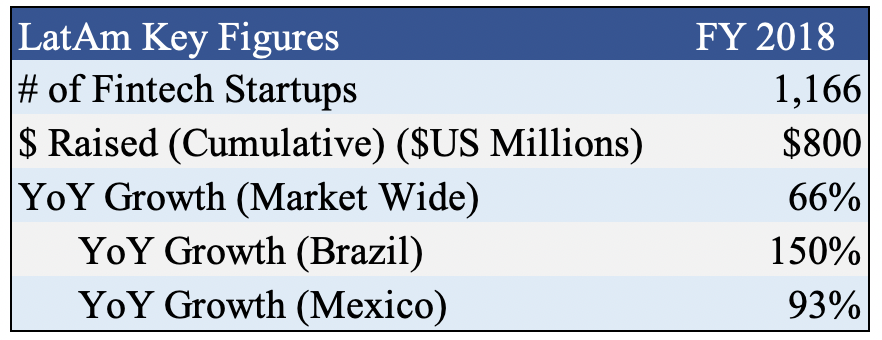

Latin America has experienced exceptional growth in the fintech space since 2018. The below figure details some key figures of the fintech landscape in Latin America in 2018.

Since 2018, the fintech landscape in Latin America has shown continued growth. A catalyst for the growth experienced in the fintech industry in Latin America has been operational changes forced by pandemic life and the increased venture capital interest in the region’s ecosystem. Latin American fintechs secured $481m in funding in Q2 2019, a six-quarter high for the region at the time.[1] This $481m in funding topped both China and India Q2 funding in 2019. The $481m is 69% of the total venture capital raised in LatAm in all of 2018. Furthermore, LatAm-based fintech funding has grown at a 57% CAGR since 2016. South America funding has grown 153% quarter-to-quarter.

Accelerated Growth Continues in the New Decade

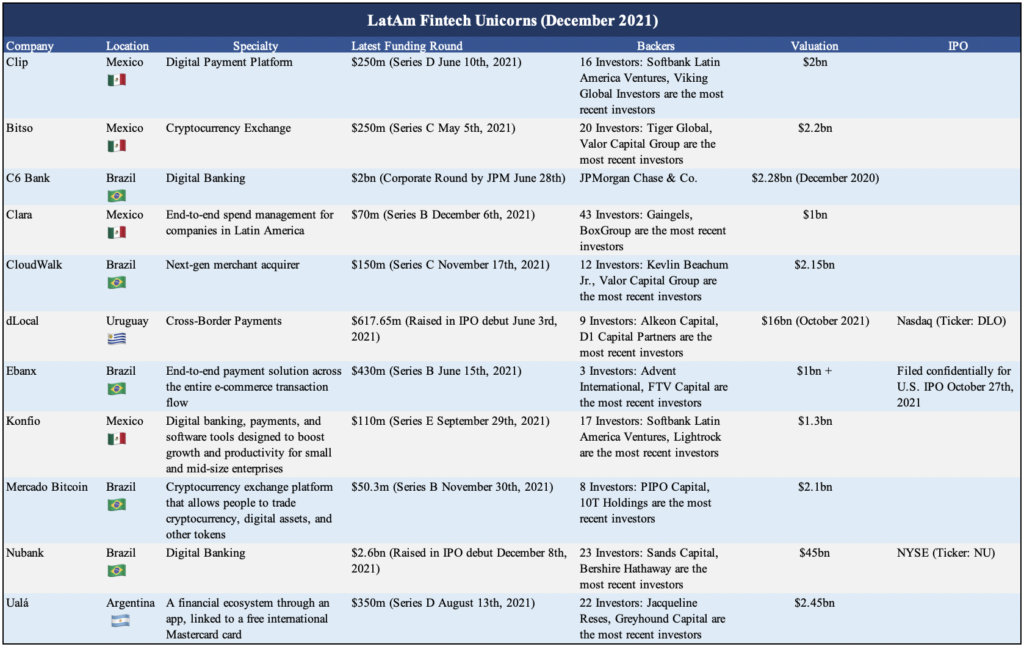

Growth trends of 2018 and 2019 continue, and interest from foreign investors builds. In 2020, VC firms invested $4bn spread over 488 transactions in LatAm startups. Fintechs saw 39% of the total amount invested in their sector. In the first half of 2021, Latin America’s fintech sector raised $7.6bn.[2] Investments increased twelvefold in the second quarter of 2021 compared with the same period of 2020. Five Latin American fintech companies achieved unicorn status in the first half of 2021 – Clip and Bitso in Mexico, dLocal in Uruguay, and C6 and Ebanx in Brazil. By December, eleven Latin American fintech companies achieved unicorn status – making up 52.4% of total unicorn startups in the region. Two firms saw U.S. IPOs in 2021 (Nubank; dLocal) and one more confidentially filed for a U.S. IPO in October 2021 (Ebanx). Uruguay’s dLocal June U.S. IPO minted a new female billionaire cofounder. Bitso achieved the status of Latin America’s first crypto unicorn. In the first nine months of 2021, startup funding is up 174% from all of 2020, with at least 25 M&A deals so far just among startups.[3]

An overview of Latin American fintech unicorns can be seen below:

Implications & Outlook

The Latin American fintech markets are red-hot and are not expected to slow down in the coming months. Major players in private equity and venture capital such as Softbank Group Corp, General Atlantic, and Sequoia Capital have their eyes on the LatAm fintech boom, fueled by the internet boom accelerated by pandemic lockdowns. Shoppers’ necessity to move online and growth in contactless payments to reduce COVID-19 spread has allowed innovators to take advantage of widespread and increasing use of smartphones, wireless networks, and payments cards. Furthermore, the comfortability of digital wallets has increased in the region. As a result, Latin America presents many opportunities for domestic and foreign businesses alike to grow by acquiring innovative LatAm-based firms. M&A can function as a key strategy for firms looking to gain a strategic advantage without developing the competitive edge they are seeking through in-house building and development – which could require a significant amount of time and capital. The current landscape in Latin America presents interesting opportunities for firms with expertise in M&A, private placements, and strategic advisory services to help clients in an exciting emerging financial technology market.

Sources

https://iupana.com/2021/10/11/bank-fintech-acquisitions-latam/?lang=en

- Commentary on fintech market and M&A in Latin America

JPMorgan makes Brazilian retail banking debut with 40% stake in C6 Bank – Reuters

- C6 bank corporate round information

Payment company DLocal raises $617.65 million in U.S. IPO – Reuters

- DLocal IPO Information

FOCUS Tech stampede as investors hunt Latin American unicorns – Reuters

- 2021 figures and outlook commentary

- Historical growth figures and commentary

Latin America Unicorn Leaderboard – The Association for Private Capital Investment in Latin America

- General Information on LatAm startups

- Nubank Valuation

[1] Fintech M&A: Latin American and Chilean Fintech ecosystems in the global eye – Philippi Prietocarrizosa Ferrero DU & Uria (Oct. 22, 2021)

[2] Bank and startup acquisitions are rising in LatAm’s hot fintech market (Oct. 11, 2021)

[3] FOCUS Tech stampede as investors hunt Latin American unicorns (Oct. 21, 2021)