Author: Andrew Woolston (Intern)

Reviewed by: Ralph DiFiore (CCO), Marcus Magarian, Chris Gioffre

As response to high valuation expectations, earnout transactions are M&A transactions in which the seller is granted additional compensation in the future if the business hits specified financial or other milestones.

For example, you, a seller, believe your company is worth $100 million today, but based on valuation metrics a fair valuation would be $50 million. A buyer will offer you $50 million, and you will receive the other $50 million upon attaining pre-determined milestones. The milestones are commonly determined by targets for gross sales, revenue, EBITDA margins, or gross profit targets. For example, the deal terms may establish that the seller will receive 5% of gross sales over the following three years.

Why Include an Earnout Structure?

Buyers

Advantages

Reduces uncertainty. Instead of an upfront lump-sum payment, the buyer benefits from a longer payment period for the business by leveraging an earnout structure (from a cash flow perspective). If earnings do not hit expectations, the buyer pays less for the business than the seller’s upfront asking price. In this sense, purchase price is directly linked to actual performance and keeps the seller incentivized to perform, reducing uncertainty for the buyer. Buyers with limited liquidity may also find this deal structure attractive because the cash or stock paid at earnout is less than the cash flow generated from the investment. Additionally, buyers do not have to turn down deals based on disagreements over valuation.

Disadvantages

Lack of planning. If improperly managed, a buyer may have to pay the earnout before cash flows can sustain the investment. It is important to conduct proper analysis on the earnout structure and understand the breakeven point at each earnout milestone. From the buyer’s perspective, cash or stock from the earnout should not exceed the cashflow generated from the investment. Additionally, earnouts do not eliminate the possibility of bankruptcy or slow growth so buyers need to conduct proper due diligence in every transaction.

Sellers

Advantages

The seller achieves their valuation. Many financial and strategic buyers utilize financial metrics such as valuation multiples when determining the upfront purchase price to pay for a company. An earnout structure allows the seller to receive the amount they think their company is worth based on expected growth. With proper analysis and understanding, earnout milestones are achievable based on the sellers’ projections of future growth. In addition, the earnout structure enables the seller to spread out taxes over the length of the earnout contract – reducing the tax impact of the sale. In addition, if the deal structure is a combination of cash and stock, the stock the seller receives could increase in value and be worth more than the total valuation.

Disadvantages

Increasing uncertainty. Juxtaposing the advantage for the buyer, it is possible the seller may not hit their desired valuation if the future earnings are lower than expected and hurdles established in the deal terms are not met. Therefore, it is imperative sellers are forward-looking – planning ahead as to the structure of hurdles and thinking about what their company looks like post-acquisition. With proper analysis, the projections and hurdles should be realistic and achievable.

Earnout’s Place in Today’s Transactions

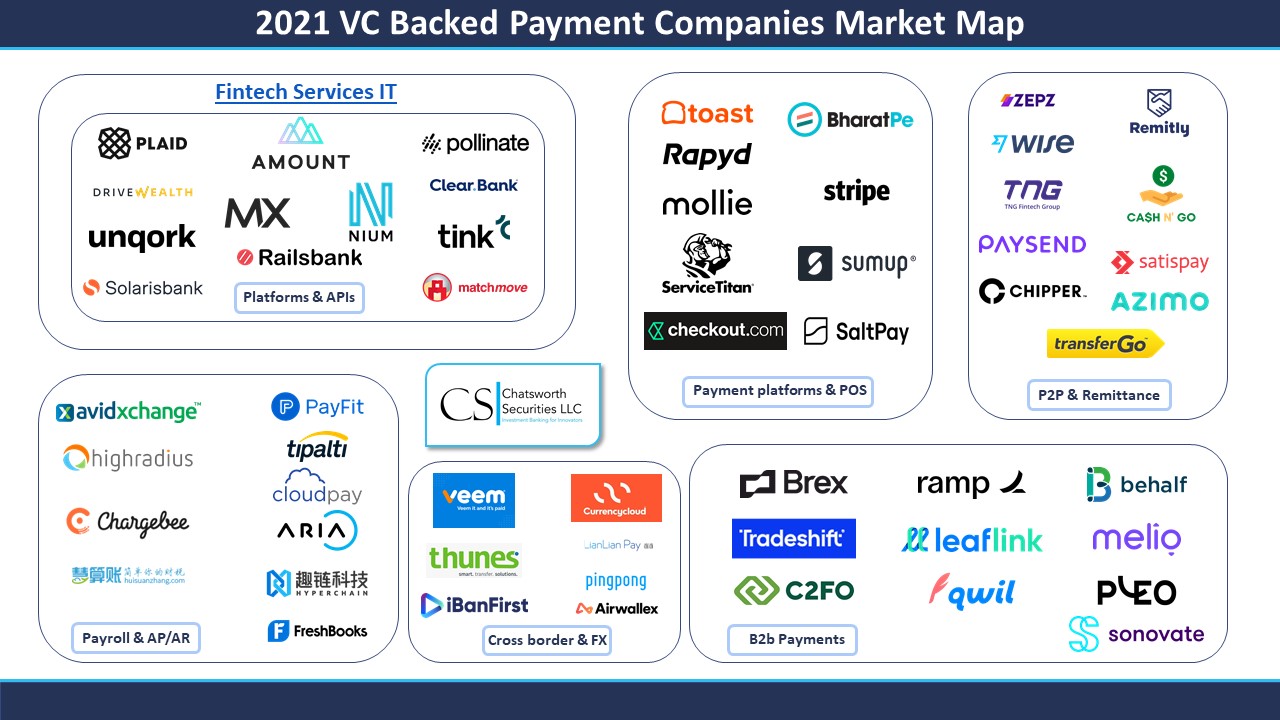

Earnouts could allow you to close a transaction in times of uncertainty. As a result of current market conditions, uncertainty surrounding the resurgence of the delta variant, and the high valuations seen in the tech industry, an earnout structure may be an attractive option for companies looking to acquire/to be acquired another/by another firm and get a transaction done. In the tech industry, earnouts may help reduce some of the purchase price risk in an industry with many M&A targets lacking a lot of operational history and a well-proven business model.

Who Leverages Earnout Structures?

Public vs. Private Transactions

Private markets favor earnout usage. A 2013 University of Chicago Law Review found only 1% of public acquisitions include earnouts while SRS Acquiom found 12% of private acquisitions involved earnouts in the same year.[1][2] Private sellers often can hide information during the due diligence process in a much greater capacity than public sellers. Due to the transparency of public sellers and regulatory requirements to disclose financial data, public transactions offer greater levels of confidence and clarity on the financial health of the seller. Additionally, public companies already have proposed valuations via share price, which lowers the variance of sale price between the buyer and seller. The financial and informational transparencies required of public companies reduces the earnout offer, in comparison to private acquisition targets.

Usage by Sector

Acquirers in the Life-Science and Tech industries favor earnouts compared to their counterparts. Life-science transactions often involve earnouts based on trials, FDA approvals, and other factors that determine a company’s financial success. Within the last 36 months, 72% of US private & public Life-Science deals included earnouts.[3] In the same timeframe, 14% of US private & public Technology deals included earnouts. 70% of the earnout transactions in tech involved revenue as an earnout metric. 36% of deals utilized an earnout length of 1 year or less, compared to 35% of life science deals exhibiting an earnout length of greater than 5 years. This discrepancy emphasizes how earnouts can be leveraged in different industries with vastly different outlooks while still providing a win-win for both buyers and sellers. Acquisition targets in the tech industry may involve earnouts due to the uncertainty around how the product will evolve and change the future market landscape – a winning technology has a short window to establish a leading presence in the market.

Highlighted Acquisition in Tech

In Lightspeed’s largest acquisition at the time (closed Jan 7th, 2020), Gastrofix was acquired for cash consideration at closing of $60m, including small cash amount for the settlement of certain Gastrofix liabilities, and approximately $44.5m in Lightspeed shares.[4] An earnout of $4m in cash and $3m in Lightspeed shares dependent on milestones was included in the deal structure.

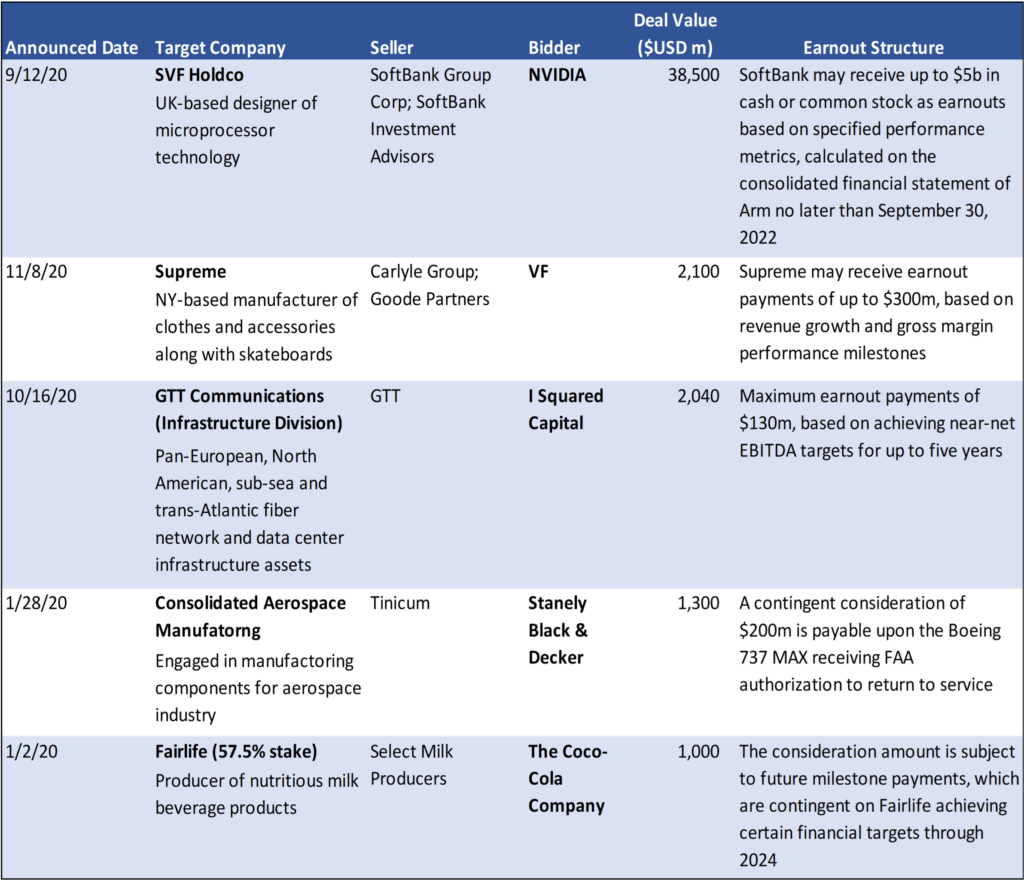

Noteworthy M&A Deals Leveraging Earnouts in 2020

Source: Acuris Capital Intelligence

Latest Posts

Archive

Sources:

[1] Brian JM Quinn, Putting Your Money Where Your Mouth Is: The Performance of Earnouts in Corporate Acquisitions, 81 U. Cin. L. Rev.

(2013) Available at: http://scholarship.law.uc.edu/uclr/vol81/iss1/3. Accessed 10 Sept. 2021.

[2] “Key Findings: SRS Acquiom 2017 Deal Terms Study.” Deal Law Wire, 2 Aug. 2017, www.deallawwire.com/2017/08/02/key-findings-sra-acquiom-2017-deal-terms-study/. Accessed 10 Sept. 2021.

[3] “MarketStandard.” Srsacquiom.com, 2021, marketstandard.srsacquiom.com/home#Earnouts. Accessed 10 Sept. 2021.

[4] Lightspeed POS, Inc. “Lightspeed Third Quarter 2020 Earnings Report”. 6 Feb. 2020. https://s1.q4cdn.com/971105498/files/doc_financials/2020/q3/LSPD-3Q’20-Earnings-Deck-vFINAL.pdf. Accessed 10 Sept. 2021