Online Banking & Data Sharing

Author: Andrew Woolston (Intern)

Reviewed by: Ralph DiFiore (CCO), Marcus Magarian, Chris Gioffre

Facebook and other social media giants have received large amounts of scrutiny regarding the transparency of data usage to their users over the past few years. For many consumers, data privacy scandals surrounding Facebook opened a can of worms. The world’s desire to control who can access their data as well as how their data is used and protected, is expected to grow. Interestingly, consumers generally are taking little initiative to keep their data protected.

Today’s Efforts

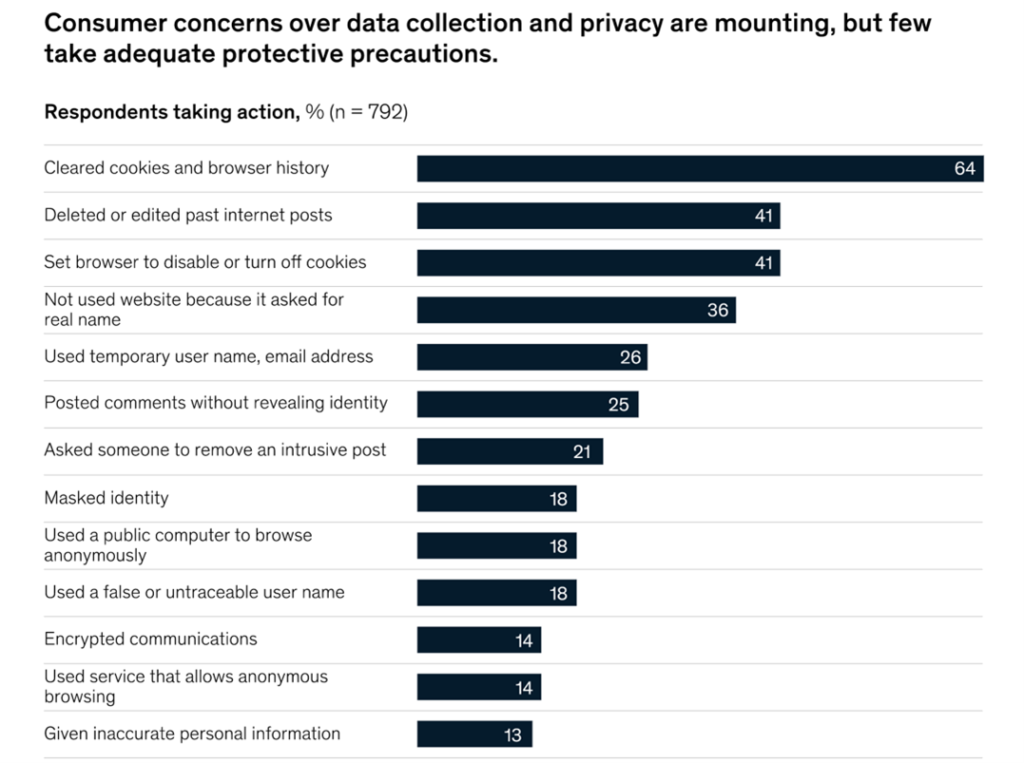

Consumers can take simple steps to address data privacy concerns. In 2020, McKinsey surveyed 1,000 North American consumers to gauge key metrics such as views, data collection, hacks and breaches, regulations, communications, and in particular industries. The graph below demonstrates the current sentiment of consumers from survey respondents. The most frequent action to protect against unwanted data collection involves clearing cookies and browser history (64% of the sample). The subsequent protective measures taken by consumers drops 23 percentage points, falling to less than half of consumers taking this action. While overall concerns and knowledge of data collection and privacy are rising, actions to combat these issues remains low.

Source: McKinsey

Data Privacy and eBanking

What do data privacy and security firms offer eBanking?

Plaid is a leader in eBanking data security solutions. With BofA rolling out Plaid data integration in 2021, Plaid has solidified itself as a leader within digital banking communities by way of transforming the customer experience. Plaid provides services to consumers concerned about data collection and privacy the ability to monitor their data – a protective precaution not listed in the above survey but important nonetheless.

Fintech unicorn, Plaid, aims to take some of the obfuscation and shadiness out of data collection in online banking by clearly and transparently providing consumers lists of third-party services users have allowed access to data, and which aspects of users’ data are shared. Plaid’s service can be offered in a bank’s online banking platforms or hosted through Plaid’s portal MyPlaid.com. Banks are attempting to give customers significant control over their data sharing, aiming to allow the turning of access off and on from within their banking platform. MyPlaid.com allows customers looking to take precautionary measures to view their connections across multiple banks and allows for more detailed knowledge about the data shared with third parties. Plaid’s customer base grew 60% last year as the pandemic forced mobile banking to the forefront of personal finances.

Announced on April 7th, 2021, Plaid’s most recent valuation landed at $13.4 billion in a $425 million Series D funding round led by Altimeter Capital Management, Silver Lake Partners, and Ribbit Capital.[1] This funding follows the collapse of a deal with Visa after DOJ antitrust concerns. The new round of funding is expected to facilitate the scaling of the company and its product lines.

Data Concerns

Data privacy and data sharing continue to be sensitive topics with the public. Plaid, like many fintech firms involved in the data sharing & privacy space, is involved in a Consolidated Class Action Complaint. The complaint was filed in September 2020 and involves 11 plaintiffs that alleged Plaid used their consumer banking login credentials to harvest and sell their detailed financial data without their consent.[2][3]

The action was partly dismissed, but as Plaid continues to respond to the privacy-related claims consumers’ confidence in the company will be challenged if there are any misgivings or lack of transparency. The Class Action reminds us how sensitive the data privacy and data sharing space continue to be with the general public.

Every consumer needs to ask themselves: Do you have a predisposition to big tech and data sharing? How concerned are you about data security? Are you a Plaid user yourself?

Latest Posts

- Chatsworth Client ZoomCar Achieves a Public Listing

- Revolutionizing the AI Landscape: An Insider’s Look at ZMBIZI’s Web 3 Mobile AI Platform

- How Can French Technology Companies Leverage the United States for Growth?

- How Do Rising Interest Rates Impact a Technology Company’s Ability to Fundraise in 2023?

- What can we expect in the Technology Sector in 2023

Archive

- January 2024

- January 2023

- October 2022

- June 2022

- May 2022

- February 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

Source:

Harkey, Scott. “Bank of America Rolls out Plaid Data Integration.” Forbes, 3 Feb. 2021, www.forbes.com/sites/scottharkey/2021/02/03/bank-of-america-rolls-out-plaid-data-integration/?sh=5a41ef5d6a11. Accessed 30 July 2021.

[1] Wilhelm, Alex. “Plaid Raises $425M Series D from Altimeter as It Charts a Post-Visa Future.” TechCrunch, TechCrunch, 7 Apr. 2021, techcrunch.com/2021/04/07/plaid-raises-425m-series-d-from-altimeter-as-it-charts-a-post-visa-future/?guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAACVyJuNI4pl3ev9dJxryoH7c7GW02stcxbkl0peqf_SN2YGuM5k4xZOQn9o91JGBsvjaF6lc7uOrG03Mzs2e42gjLayzOSfuhGN4pk7nN53W3Sr_SwIku-patcCxuToGTQ49oRJU1K9Z4lDM5PH8AS_B8dxCTOuxJbFfZeVp6pGG&guccounter=2. Accessed 30 July 2021.

[2] “Plaid Federal Electronic Surveillance Claims Dropped, Privacy Claims Survive | JD Supra.” JD Supra, 2021, www.jdsupra.com/legalnews/plaid-federal-electronic-surveillance-3374087/. Accessed 30 July 2021.

[3] “Plaid Partially Successful in Tossing out Class-Action Complaint – Privacy Allegations Still Remain.” The National Law Review, 2021, www.natlawreview.com/article/plaid-partially-successful-tossing-out-class-action-complaint-privacy-allegations. Accessed 30 July 2021.